House Rent Allowance (HRA) is a significant part of a salaried employee’s compensation package. It is offered by employers to assist employees in meeting rent payments. HRA is exempt partly or wholly from tax under Section 10(13A) of the Income Tax Act, subject to certain conditions. Knowing about HRA can assist one in availing maximum tax benefits and minimizing taxable income.

This article provides an in-depth guide to HRA, including its calculation, tax exemptions, and eligibility criteria.

Table of Contents

What is HRA in Salary?

House Rent Allowance (HRA) is an allowance given by an employer to employees for paying their rent. It is a component of the salary and depends on various factors like location, basic salary, and employer rules. HRA is a crucial component of an employee’s income, especially for those who live in rented houses.

How is HRA Calculated?

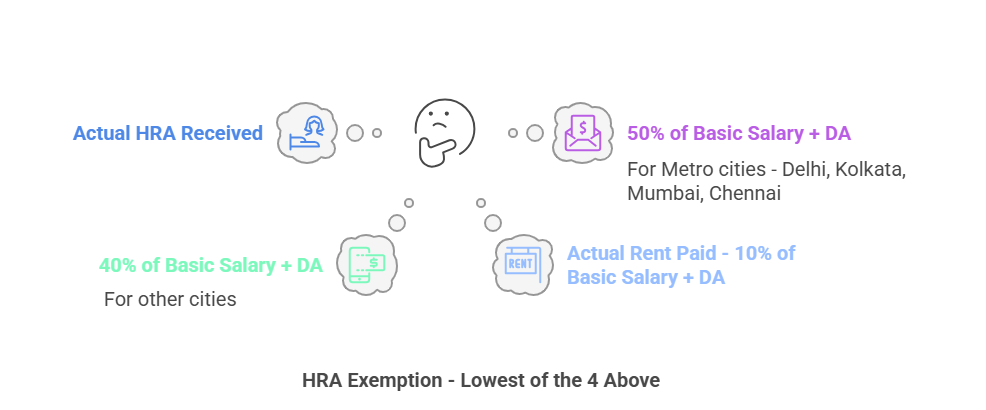

The House Rent Allowance (HRA) paid to an employee will vary based on several factors, including salary, city of dwelling, and actual rent paid. The tax-free HRA is calculated by taking the minimum of the following three conditions:

Actual HRA received from the employer

50% of basic salary (for employees living in metro cities like Delhi, Mumbai, Kolkata, and Chennai) or 40% of basic salary (for non-metro cities)

Rent paid less 10% of the basic salary

House Rent Allowance Calculator

Example Calculation:

Basic Salary: Rs. 50,000 per month

HRA received: Rs. 20,000 per month

Rent paid: Rs. 18,000 per month

Location: Non-metro city

Tax-exempt HRA = Lowest of the following:

HRA received = Rs. 20,000

40% of Basic Salary = Rs. 20,000

Rent paid – 10% of Basic Salary = Rs. (18,000 – 5,000) = Rs. 13,000

Here, HRA tax exemption will be Rs. 13,000 every month, while the remaining amount of Rs. 7,000 will be taxed.

How Do I Claim 100% HRA?

You can only claim 100% House Rent Allowance (HRA) tax exemption in certain circumstances. The below are the steps which can maximize your HRA exemption:

Ensure You Live in a Rented Property: You will have to pay rent for the residential accommodation if you wish to claim HRA.

Keep Proper Records: Keep rental receipts, lease agreements, and proof of payment of rent (like bank remittances) as records.

Reside in a Metro City: Given that metro cities provide up to 50% HRA tax exemption as against 40% in non-metro cities, residing in a metro enables better claiming of exemptions.

Design Compensation Appropriately: Where feasible, negotiate with the employer for higher HRA constituents in your salary structure.

Submit PAN of the Landlord: If rent for the year is more than Rs. 1,00,000, submission of your landlord’s PAN is required.

Claim Deduction Under Section 80GG: In case you are not getting HRA but still paying rent, you can avail benefits under Section 80GG of the Income Tax Act.

What is 18% HRA?

The term 18% House Rent Allowance (HRA) is misinterpreted. In taxation, HRA itself is not taxed at 18%. But if your employer offers HRA as a part of your Cost to Company (CTC) and doesn’t deduct tax, you can come under the 18% GST slab if applicable under certain conditions, like renting commercial property. For residential property, GST is not charged on rent.

HRA Full Form

The complete name of HRA is House Rent Allowance. It is an essential element in the salary of an employee that takes care of the rental costs while providing tax advantages.

HRA Tax Exemption Rules

HRA exemption under Section 10(13A) of the Income Tax Act, 1961, is calculated as below:

Eligibility: Tax exemption for HRA is admissible only when the employee stays in a rented house and is paying rent.

Exemption Calculation: The lower of the following is exempt from tax:

Actual HRA received

50% of Basic Salary for metro cities and 40% for non-metro cities

Rent paid less 10% of Basic Salary

PAN of Landlord: Mandatory if rent paid is above Rs. 1,00,000 per annum.

Exemption under Section 80GG: Eligible for self-employed professionals or salaried employees not receiving HRA.

How to Claim HRA Tax Exemption?

To claim HRA tax exemption, proceed as follows:

File rent receipts to your employer prior to the financial year-end.

Keep proper records like rental agreements, PAN of the landlord, and proof of rent payment.

Report HRA component while filing ITR (Income Tax Return).

Calculate tax savings using an HRA calculator.

Exemptions for Self-Employed Individuals

If you are self-employed or a salaried person without HRA, you can claim deductions under Section 80GG subject to the following conditions:

Maximum relief: Rs. 5,000 per month or Rs. 60,000 per year

Rent paid cannot be more than 10% of total income

No house property is to be owned in the location of residence

FAQ

What is HRA in Salary?

HRA, or House Rent Allowance, is a part of an employee’s salary given for bearing the cost of rent. It is exempted from income tax partially or fully based on eligibility rules.

How Can I Claim 100% HRA?

If you want to claim 100% exemption in HRA, make your rent value high, reside in a metro city, maintain documentation, and design your salary for an increased HRA component.

What Is 18% HRA?

The term “18% HRA” has no relevance for HRA taxability. Nonetheless, if HRA comes under certain GST provisions, it may be taxed with 18% GST in the case of commercial renting.

What is the Full Form of HRA?

The full form of HRA is House Rent Allowance.

How is HRA Tax-Exempt?

HRA is exempt from tax under Section 10(13A) of the Income Tax Act. Exemption is allowed on the lower of the following:

Actual HRA received

50% of Basic Salary (metro cities) or 40% (non-metro cities)

Rent paid less 10% of Basic Salary

Can I Claim HRA If I Own a House?

No, if you have a house in the same city where you work, then you cannot take the benefits of HRA unless you can demonstrate that you are living in a rented house and your owned house is not inhabited.

Can I Claim HRA If I Pay Rent to My Parents?

Yes, you can avail of HRA by paying rent to your parents. But you must have a rental agreement and make sure that your parents show rental income in their ITR.

HRA vs. Home Loan: Which is Better?

HRA and home loan benefits both cut taxes. You can claim both together in certain cases. But be sure to check what rules apply to your situation.

Also Read - How Much Rent Can You Really Afford?

Conclusion

House Rent Allowance (HRA) is an essential component of a salaried worker’s salary, offering tax relief alongside covering rent payments. By familiarizing yourself with HRA tax exemption regulations, eligibility, and documentation, workers can save maximally. Whether you are a salaried person or self-employed, having an idea of how to claim HRA optimally can significantly reduce your taxable income. Following the advice given in this article, you can take a well-informed financial decision and optimize your HRA-related tax benefits. If you are looking flat in Chandigarh to rent, then visit Lets Rentz.